Buying & Selling Marinas March/April 2025

Our March April dive into the marina real estate available around the world.

Megayacht marina opportunity in Phuket

The Na-Ranong family, well known for having played an instrumental role in the development of the thriving tourism industry in Phuket, Thailand, is looking for investors for a world-class marina development on the east coast of Phuket at Sapam Bay.

This tract of land at Sapam Bay has been approved for developing one of the last marinas in Phuket and is available for sale or long-term lease.

Stategically located just 20-30 minutes away from Phuket Old Town and in a scenic position, the marina will be able to host yachts up to 50m (164ft) in sheltered waters, and large vessels of 50-80m (164-262ft) outside the basin. A total of 50-60 yachts owned by both private and commercial clients will be accommodated.

The marina plot of 6.08ha (15 acres) offers ample space for top-tier facilities and an adjacent 6.92ha (17 acres) is available for dry dock facilities, a luxury clubhouse or bespoke amenities for yacht owners. A further 7.9ha (19.5 acres) is offered as an additional opportunity, if required, for the development of luxurious residences with stunning views of Phang Nga Bay and the Andaman Sea.

Krystal Prakaikaew Na-Ranong says the family is flexible in terms of either offering the site as a long-term lease project or for sale to the right buyer. There has already been interest amongst investors in Thailand and Europe.

Phuket Governor, Sophon Suwannarat, endorses the opportunity: “Phuket is fast becoming the boating capital of Asia, and we welcome the development of this marina site, which will not only attract more high-spending international tourists, but will considerably enhance Phuket’s economic growth. There is a real need for marina capacity in Phuket to grow and we applaud this development opportunity, which will significantly enhance Thailand’s nautical tourism credentials.”

Known as the ‘Pearl of the Andaman Sea’, Phuket is famous for its year-round marine tourism and boasts a vibrant yachting scene, along with a thriving scuba and snorkelling industry, attracting millions of tourists each year.

Investors will be able to capitalise on strong returns thanks to Phuket’s position as one of the world’s most popular destinations, with tourist numbers set to double by 2030. Marina developments deliver strong economic benefits to the local community by attracting high-net-worth individuals and megayacht owners from across the globe, positioning the project for success. This will be one of the last marina opportunities in Phuket and thus an extremely attractive investment, especially as marinas with megayacht capacity are rare.

With access to the full parcel, investors will be able to develop the site in a phased manner as required.

Enquiries: pr@theslatephuket.com

Beware of ‘bypass’ buyers

Seeking professional help when you consider selling your marina is not an unnecessary expense but a measure that will help you achieve a smoother sale process and optimise your sale value. US-based Rick Roughen, a commercial maritime broker with National Marina Sales (NMS), gives guidance.

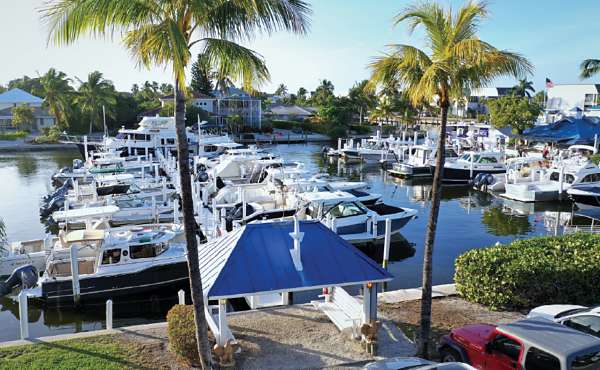

Taylor Creek Marina in Fort Pierce, Florida was sold for the second time in less than three years by NMS and is now in the hands of a highly regarded consolidator.

Eventually it became apparent that opportunities for adding value were clearly abundant in most marinas operating across the country. And at some point, it became crystal clear that the marina market could indeed render lucrative returns for investors, and as a result, the recent and now current prognosis is that the marina acquisition market is a highly regarded “space” for investment. With that, buyers have confirmed their positive opinion of the marina industry and are now aggressively pursuing opportunities and bolstering their approach to locking up deals… and the race is on.

Rick Roughen

Now, more than ever, sellers who are successful marina operators face a daunting task as they consider the idea of whether to sell, how to sell, when to sell, and to whom? Visions of being retired occupy the minds of many who end up walking into a transaction with their pride and joy, their livelihood and their nest egg being at risk for a hungry buyer to take. Many have not properly prepared themselves or their operations prior to making that move, and by chance they suppose it will all work out with a buyer group that seems to have everything in order and a “great reputation.” Again, all of that may be true, and there may be logic for moving forward with those folks to get a deal done. But one should consider the process, how to prepare, and all that stands ready to imperil a buyer as he or she forges ahead into the world of mergers and acquisitions.

Sanibel Island Marina and Grandma Dot’s Café in southeast Florida achieved a top of the market sale as the elderly owner was advised by NMS on all aspects of the transaction.

The seller could be subject to an endless chain of diligence requests, relationship coddling to gain the seller’s false confidence in a buyer, escrow holdbacks where sellers sink their “hooks” into large chunks of the seller’s cash after closing, and many other strategies that put them in a better position to control the deal. It is not unusual for sellers to realise after the fact that the “simple contract” their buyers referred to is really 90 pages long, that the “quick push” through the due diligence period they were sold on really ends up taking many months with delays and extensions, and assurances given that “they could close quick with cash” actually go way beyond what was expected while the sellers’ facility is restrained from being available to and considered by other buyers.

The NMS team advised in transactions to sell Rivertowne Marina in Cincinnati, Ohio (twice in three years). The second transaction was to a major acquisition group which is aggressively expanding the facility.

Many sellers are proud to have the attention and happy to sign that document thinking they have skirted the limelight, the headaches, and the costs of hiring a professional to look out for their best interests. After hearing that their marina is “unique” (and every marina is) and that there is nothing to lose (when there most certainly is), it is tempting to just go ahead and sign. Unfortunately, in some cases the intent is to simply tie up the property so they can have a look, get information and keep it off the market while they peel back the layers of issues they will face. Sellers have been falling for it and the resulting loss of control of the deal often leads to gobs of sellers’ money being left on the table.

Grafton Harbor, Grafton, Illinois is currently on the market with NMS after the seller lost time and money engaging with an institutional buyer.

Find a solid marina broker (who only sells marinas, boatyards and shipyards). Talk with the broker and ask as many questions as you can. Hear your broker’s thoughts and realise that he or she is there to help you and to guide you through the process. Ask up front for an explanation of the sequence, how they will determine value (Brokers Opinion of Value), how they will build your package and how they will advertise your opportunity. Be convinced that they are focused on working for your best interests and that they can be trusted to keep you out of unnecessary problems. Be sure they are well-versed in marina operations and financial statements. If they have operational experience, all the better.

Find a good real estate attorney. Meet with that person and let them know what you are planning to do. If you like what you see, then ask your broker to call that person so they can begin to work together. Don’t engage your attorney too soon, but have the broker do the work for you up front. Before anything is signed, get it in front of your attorney to review.

Get an appraisal with an MAI appraiser and consider doing a Phase I to understand up front how your property fares on the environmental side. Your professionals will advise you on all the rest.

Do not do it alone.

www.nationalmarinasales.com

First time sale for inland marina

Farndon Marina, located on the UK’s River Trent near Newark in Nottinghamshire, comes to the market for the first time since being established nigh on 60 years ago.

The marina comprises over 300 private berths and moorings, with berthing fees and chandlery sales forming the backbone of the business, together with boat brokerage and marine services which incorporate repair, maintenance and boat lifting. Recent investments have been made in technology to improve day-to-day operations and site security, and to enhance customer experience. Amenity buildings including workshops, visitor facilities and office space have been developed.

Farndon Marina is a well-established business with several opportunities for a new owner, including the development of holiday park, motor home and touring caravan facilities, extension of the boat brokerage business, and the potential to introduce floating lodges (subject to the necessary planning permissions).

“Since my father passed away over 16 years ago, Janet and I have continued as custodians of this incredible business,” Paul Ainsworth explains. “We have consistently invested in improving the facilities and customer experience, and have a fantastic team, who are and will continue to be great assets to the marina. We are at that time in our lives where it makes sense to pass the reigns to new owners. I’ve been contacted many times over the years asking if we would sell, and so this tremendous opportunity now becomes a reality.”

Farndon Marina is being marketed by specialist leisure property advisor Christie & Co. Jon Patrick, head of leisure and development, who is overseeing the sale process, anticipates that interest will come from a diverse range of parties.

Enquiries: leisure@christie.com