The future of government marina leases and concessions by Darren Vaux

Marinas provide essential boat storage, vessel maintenance, supplies and amenities that support the boating community and the broader community through employment, economic activity, tourism and the social wellbeing arising from the human interactions associated with boating activity. In many locations, they drive tourism as they continue to transition from ‘boat parks’ to tourism destinations. As a consequence, they require higher levels of management expertise and capital investment.

Marina investments and businesses are characterised by challenging/high risk government planning controls (which delay investment), large initial capital requirements, high maintenance costs, and high management costs. They are not passive investments and require attention to detail and customer service. They require ongoing adaption to market needs through additional capital investment and change in offering and management approach. In many respects, they are similar to hotels from a management intensity viewpoint with the added complexity of the marine environment and the technical aspects of meeting the infrastructure needs of large vessels.

Marinas also have the added complexity of having all or some of their property rights derived from government leases and concessions. To attract and retain capital for marina investments, marina investors and operators need to achieve a return on investment commensurate with risk and effort and the nature and fluidity of government policy has a significant impact on this risk profile. Consequently, marina investments require the support of government agencies in the provision of leases or concessions that support the development, operation, maintenance and re-investment required to deliver and maintain high quality marina infrastructure in the best interests of the community.

To establish a sustainable leasing framework between government and the marina industry the objectives of each party need to be understood.

Darren Vaux

Marina investors and operators want a leasing framework that promotes attractive and sustainable private sector investment in the development, operation, maintenance and ongoing enhancement and adaption of maritime properties and the development of value in business goodwill to meet the current and changing needs of the boating public and broader community.

Like all investments, marinas rely on an economic model where there is a demand for services that is not met by existing suppliers or competition. Having satisfied that fundamental issue, the key challenges that marina investments face are as follows:

• Project and investment: the physical aspects of the proposed anchorage. Factors like water depth, fetch, exposure, tidal movement, current, access and ecology all have significant impact on the complexity and capital requirements of the marina infrastructure. This is particularly important where long term marina investments need to contemplate the ability to adapt to the consequences of accelerated climate change.

• Planning: planning law and environmental constraints are often a significant impediment and cost imposed on marina development. The planning complexity of building over foreshore and water invokes complex planning law challenges that often mean that planning consents for marinas take many years and are much more difficult and expensive than comparable landside developments. This directly affects both the access to, and return on, capital for marina investments.

• Lease contracts and funding: the availability and terms of government concessions/leases affects both the initial and ongoing investment security of marinas. Marina concessions are many decades in length and payback periods on marina investments are long. This can be very challenging in an environment where government policy towards concessions changes in cycles more commensurate with political cycles of a few years and consumer behaviour and technologies require ongoing adaption and investment. Fixed term leases undermine the ability to attract and retain investment capital. Debt funding remains challenging as marinas are treated as ‘specialised assets’ under Basel III banking standards and, as such, are subject to tighter lending criteria than competing landside investments. This manifests in a larger demand for equity and consequential higher weighted cost of capital ( WACC) compared to landside investments. This is primarily due to the uncertainty of the security of government concessions, but can be overcome with adoption of lease or concession principles that encourage and support investment as set out below.

There are four key elements of marina concessions/leases that affect the investment quality of the lease/concession:

• Rent

• Lease term, options and renewability

• Administrative burden and constraints

• Performance criteria

Rent

Rents payable for marina concessions should provide a fair return to government while meeting the criteria of being a sustainable cost of occupancy for the marina investment. Consequently, this sustainable occupancy cost of marina concession rents needs to be considered on a case by case basis based on the business model for a given marina. Seabed area is not a reliable factor in determining the amount of rent a marina should pay. The amount of area required to accommodate a given amount of boat storage is highly dependent on a number of key factors including:

• The water depth and seabed profile – this will affect how far from the shore the boat storage can start, the configuration of the marina and the depth of piles or other supporting infrastructure.

• The exposure and fetch – this will determine whether a breakwater or wave attenuation system is required to create a marina basin that is suitable for boat storage.

• Tidal range and current – this will determine marina orientation and gangway design and location.

• The size and nature of vessels to be stored – larger vessels, motor boats and sailing yachts have different physical characteristics, infrastructure needs and manoeuvrability which affect the design and configuration of marinas.

Based on the factors above, seabed area requirements can vary by more than 100% for a given amount of boat storage and, as a consequence, seabed/land area is an unsuitable factor for use or comparison to determine marina rents.

Marina rents can be determined using a residual land value/rental cost from a marina business case and investment model. This approach looks at the potential earning capacity of the marina less operating costs to determine gross profit from operations and then factors in the initial investment, depreciation, amortisation and market referenced benchmarked returns to determine the component of revenue the marina can afford to pay in rent and remain a viable, sustainable and competitive investment. This is known as the ‘Sustainable Occupancy Cost’, the principles of which have been established by Industry and are the subject of an ICOMIA IMG Policy Statement dated June 2018.

Sustainable occupancy cost is often expressed as a percentage of turnover for a particular component of a marina operation. This will need to be determined from first principles in each jurisdiction but is based on a ‘residual land value’ valuation approach outlined above. The variable nature of these factors means that there is a range of outcomes. Review of rents around the world sees a 90% range of 2-8% with a mean of around 6% of annual gross turnover before taxes. This is applicable on the basis of long and renewable tenures and where the creation of the marina basin (excavation and breakwaters) is not funded by the marina investor. Rents above these levels lead to poor investment outcomes, and consequently poor public infrastructure and economic and employment outcomes.

Marina concession rents determined using the sustainable occupancy cost model and reflected as a percentage of turnover have the following advantages:

• They are a fair reflection of the earning capacity of the site

• They adapt to relative market values as higher berthing charges in premium areas are reflected in revenue and vice versa

• They adjust to market fluctuations in the long term

• The percentage of turnover can reflect the scale of investment and security of tenure

• They overcome the challenge that market comparisons are difficult as no two marinas are alike and other land uses are not directly comparable

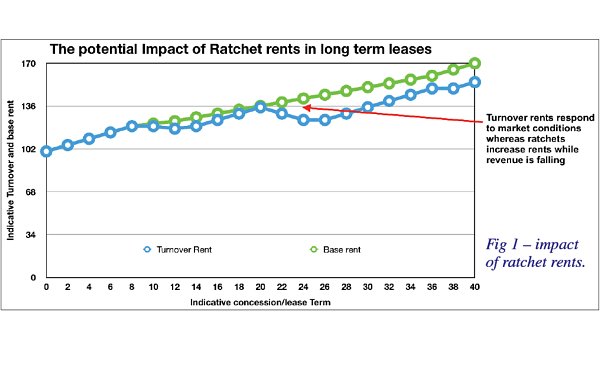

It is essential that long term marina lease clauses do not contain ratchet provisions for rent. The benefit of turnover rents is that they respond to economic conditions over time such that the landlord and lessee share the benefits of the good times and the challenges of the down times. Ratchet rents impose a cost burden on the lessee in a falling market at a time when the business is under pressure from other fixed costs (see figure 1).

It is important to note that marinas are often not, from a valuation point of view, the highest and best use (using the valuation definition) of waterfront land. This is typically residential or other property use with a high value per square metre. Marinas are regional infrastructure that have economic and social values way beyond their boundaries. They are essential infrastructure for public access to the waterways, and infrastructure and access for waterway users, and the land should be valued with consideration to these constraints. This is important when government valuations are used to determine land taxes or other value related taxes and marinas should not be burdened with valuations determined from higher use options in this way.

Lease terms, options and renewability

An essential requirement for competitive, sustainable and viable marina investments is the certainty of long-term tenure and renewability of same. Leases and concessions are the legal instruments used to provide the rights to private investors to develop and operate marinas on public land where the government does not wish to offer - or is not capable of offering - the land for freehold sale. An inherent limitation of a lease or concession instrument is its fixed term, which is not compatible with the investment, operation, growth and re-investment of marina infrastructure and businesses. Fixed term leases without renewability force a business model where the assets and goodwill of the operator are amortised to zero by the end of the term. Marina business goodwill is not portable as it is geographically co-dependent. Where marina investors and operators are provided with the opportunity to renew their leases, they will adopt a business model that maintains the marina infrastructure, re-invest to adapt to market changes and focus on providing customer service outcomes that grow goodwill. The comparison of business models for amortisation versus re-investment is set out indicatively in figure 2.

From a government landlord point of view, where turnover rents are adopted as set out in figure 2, the landlord will see growth in return as it is tied to the financial performance of the marina operator (see figure 3).

Initial lease terms should be a minimum of 40 years with terms included within the lease for extension of the term of the lease based on either mid-term re-investment or maintenance of the marina to an infrastructure and operating standard. Existing industry recognised schemes available to validate these criteria include the Global Gold Anchor Scheme, Blue Star, Clean Marinas and Blue Flag. An example of how this could be applied is where a marina is 20 years through a 40 year lease and has applied ongoing capital and maintenance to a given Gold Anchor standard, the marina is granted a ten year extension at each ten year review period allowing the marina to maintain a minimum remaining term of 20 years providing it maintains the operating performance to the accreditation standard. For larger tranches of capital investment longer terms would then apply. This can be formularised into lease instruments. The challenge is that it does provide a mechanism for perpetuating leases and some legal controls may be required to address this technically. The objective, however, from an investment point of view is the lease delivers rights equivalent to freehold property where governments retain the right of resumption through the payment of compensation and that the concession/business is available to other investors through the acquisition of the business including its infrastructure and goodwill.

To be very clear, the concept that a marina business is put up for tender by the government landlord at the end of a fixed term where the government then achieves a windfall from the infrastructure investment and goodwill development of the current operator is clearly not sustainable, moral or reasonable and delivers very poor outcomes for all parties. We need to change this thinking and approach and establish a new paradigm for this commercial relationship.

The ICOMIA Marinas Group (IMG) has developed a policy on marina lease tenures, which can be downloaded for free from the ICOMIA Library at https://icomia.org/icomia-library

Administrative burden and constraints

Marina leases and concessions typically allocate all of the risks of operation, health and safety, environmental compliance and insurance risk to the marina investor/operator. At the same time, there is a tendency to incorporate within lease documents administrative burdens and constraints to give the government landlord some ‘control’ over the marina operator. These reporting and approval processes are largely redundant due to the risk allocation and impose an administrative burden and cost on both the marina operator and the government landlord.

These circumstances are more favourably dealt with by preparing a schedule of reporting criteria and exception reporting so that key information and advice is given as required. Government landlords can take further comfort from the marina’s participation in industry accreditation programmes relating to operating standards and environmental compliance as outlined below.

Performance criteria

Leases and concessions by their very nature set minimum performance criteria and sanctions for failing to meet these criteria. This again is an area where the typical lease/concession legal instrument falls short on delivering the legal framework required to incentivise the pursuit of excellence in the development, operation and re-investment in marina infrastructure. The incorporation of criteria within marina leases or concessions that reward measurable performance or outcomes is in the benefit of all stakeholders. Examples of these performance criteria could include:

• ISO or National Marina Standards

• Maintenance of service and infrastructure standards as measured by the Global Gold Anchor programme

• Maintenance of environmental outcomes as measured by the International Clean Marina programme

• Performance against other criteria specific to a particular marina, which might include boating public access to services and facilities at the marina, an example of which is the Sydney Harbour Destinations Plan in Australia [https://www.rms.nsw.gov.au/maritime/using-waterways/boating-destinations-plan/index.html]

The incorporation of these positive incentives within marina leases for the maintenance of standards for infrastructure and public outcomes is far more effective than minimum standards and sanctions in delivering positive community outcomes in the long term.

Marina lease/concession frameworks that incorporate the principles of sustainable occupancy costs for rents, provide long lease terms with renewability for re-investment or meeting performance criteria and adopt administrative terms that are not a burden to the landlord or lessee provide the framework for the delivery and operation of long term high quality and valuable marina infrastructure. They incentivise ongoing improvement and the pursuit of excellence. They promote competition based on quality of services and infrastructure, not just price. They create tourism attractions for towns and regions with commensurate economic activity and employment and they support an industry whose sole purpose is the enrichment of people’s lives through access to all forms of recreational boating. Our industry must clearly articulate this message. The benefits to the community and a proactive and long term vision from government policy makers will be in the best interests of their constituents. In some respects, it requires a change of mindset from industry and government alike, to adopt a proactive and collaborative approach where both parties can meet or exceed their expectations and where the ultimate beneficiary is the broader community.